Actual Cash Value Appraisals

Actual Cash Value Appraisals: Federal Emergency Management Agency (FEMA) have new requirements. Participation in the National Flood Insurance Program (NFIP) requires additional responsibilities. Properties within the flood hazard zones must comply with requirements as it applies to structures. The Flood Plain Administrator and local offices are responsible for application of the NFIP/FEMA requirements.

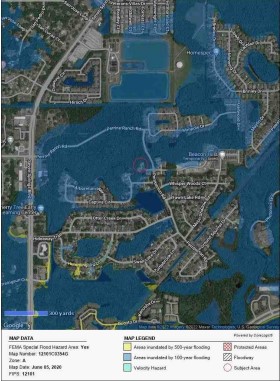

Know Your Zone ttps://www.FEMA/maps.

Structures that adhere to the current codes do not need to comply with additional requirements such as an actual cash value appraisal. Therefore, elevation by either construction or land build up may adhere to current requirements. In this case only the typical building codes impact the permitting process. Conversely, structures that do not adhere to NFIP/FEMA codes require additional efforts.

FEMA would prefer removal of non-conforming improvements. Demolition and removal of the structures can be costly to the owner. As a compromise, the NFIP adopted the 50% rule. This allows for the continued use of older buildings. The 50% rule limits the actual cost of construction at any given time, thereby reducing the risk to the NFIP.

Upon application the permit department can inform the applicant of the dollar limit of the new improvements. In some counties, the FEMA letter is on the county appraiser site as it relates to the property address. For instance, should this amount be less than needed, the property owner has the option to explore actual cash value appraisals.

Most importantly, have the report completed by a State Certified Appraiser with experience in preparing actual cash value reports for FEMA compliance. The reports developed for this specific purpose are vastly different than those developed for lending or insurance. Despite years of experience, it is imperative that the appraiser is familiar with the new requirements. For further information on actual cash value appraisals for the FEMA 50% rule contact Shari Peterman at 727-505-6706 for more info visit https://www.fema.gov