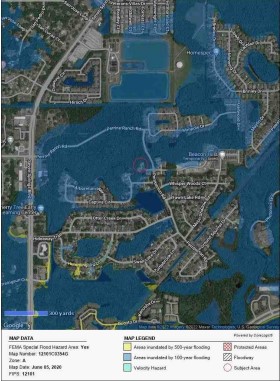

The FEMA 50% rule 2022 requirements involving appraisals have changed significantly. Communities participating in the National Flood Insurance Program (NFIP) have added responsibilities. Properties within the flood hazard zones must comply with stringent requirements as it pertains to permits. The local municipality, under the guidance of the Flood Plain Administrator are responsible for upholding the NFIP/FEMA requirements.

Structures that adhere to the current NFIP/FEMA codes are not at liberty to comply with additional requirements. Conversely, structures that don’t adhere to the current NFIP/FEMA codes are at liberty to comply with additional requirements. Consequently. elevation would be the preferred solution under FEMA.

Demolition and removal of the structures may not be financially feasible to the owner. As a compromise, the NFIP adopted the 50% rule. This allows for the continued use of nonconforming buildings. The 50% rule limits the allowable improvements at any given time, thereby reducing the risk to the NFIP.

The permitting department of the local municipality can inform the person applying for permits the dollar limit of the improvements. Often, the county appraiser site will post the allowable amount as it corresponds to the property address. Should this amount be insufficient or otherwise seem incorrect the property owner has the option to obtain an independent appraisal. Certainly, obtain the report from a State Certified Appraiser with sufficient knowledge and experience in this particular type of appraising. The reports developed for this specific purpose are significantly different than those developed for lending purposes. Despite years of experience, it is imperative that the appraiser is familiar with the new requirements. For further information on the FEMA 50% rule 2022 contact Shari Peterman at 727-505-6706.

Real Estate Appraisal – home appraisal – appraiser – real estate appraiser – residential appraisals – New Port Richey, FL – Priority Appraisal and Mortgage Services, Inc. (appraiserxsites.com) https:/www.facebook.com/priorityappraisaltampabay